Harnessing Distributed Energy Resources for ASEAN’s Energy Transition

The energy transition in Southeast Asia is gathering momentum, but the road ahead remains complex. For countries like Vietnam, Indonesia, the Philippines, Cambodia, and Thailand, the challenge is not only decarbonizing electricity supply but doing so in a way that keeps pace with demand growth, maintains grid reliability, and delivers equitable outcomes.

While large-scale infrastructure plays a central role, Distributed Energy Resources (DER) decentralized energy technologies that are located close to the point of consumption offer practical and scalable solutions to bridge the gap between growing energy demand and decarbonisation goals. Some DERs in Southeast Asia typically include:

- Rooftop Solar (RTS): Small-scale solar PV systems installed on residential, commercial, or industrial buildings. This segment has seen rapid uptake in countries like Vietnam and Thailand due to feed-in-tariffs and net-metering policies.

- Microgrids: Localized grids that can operate independently from the main grid. These are increasingly used in island or mountainous areas to improve energy access and resilience.

- Community Renewable Energy: Locally-owned and operated energy systems, often combining solar PV, wind, or small hydro with storage. Community energy systems are technologically similar to renewable microgrids but include a change in governance to empower communities as owners, operators and generators of electricity services, not just consumers. While still emerging, these systems are gaining interest for electrifying remote or underserved areas.

- Battery Energy Storage Systems (BESS): Provide grid stability and flexible dispatch capacity for intermittent renewables. Though adoption is still early-stage, declining battery costs are making BESS more accessible.

AMPERES has been working across the region to support governments, utilities, and local communities to integrate DERs in ways that enhance system flexibility, unlock investment, and build resilience. This article shares some of the key insights we’ve gathered through this work.

The generation challenge in ASEAN

Southeast Asia is on course to account for 25% of global energy demand growth between now and 2030, second only to India over the period. This is more than double the region’s share of growth since 20101, driven by the recent economic expansion and rising living standards. This development has long depended on fossil fuels, particularly coal and gas, which dominate energy mixes across the region. Renewable energy is gaining momentum, but the scale-up faces significant headwinds due to technical constraints and the need for government mediation and incentives.

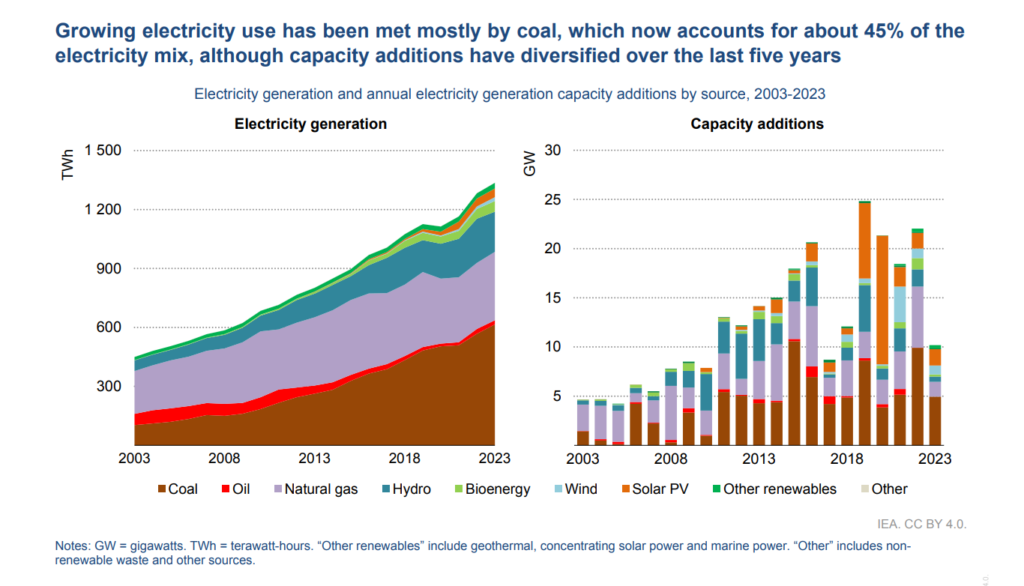

Figure 1 shows that the growing electricity use has been met mostly by coal, which now accounts for about 45% of the electricity mix, although capacity additions have diversified over the last five years show the evolution of electricity generation and capacity additions by source in ASEAN from 2003 to 2023. Notably, solar PV and wind have seen significant increases since 2018, indicating a shift not only in fuel source but also in the way electricity is generated.

Growing electricity and annual electricity generation capacity additions by sources in ASEAN from 2003-20232

In Vietnam, a boom in solar development between 2019 and 2021 added more than 16 GW to the grid with half of this portion come from RTS, a key category of DERs3. However, the lack of planning and coordination has led to curtailments and regulatory uncertainty. The same technical and regulatory problems hinder the development of clean energy sources in ASEAN countries. Indonesia, which is home to the world’s fourth-largest population, still sources over 60% of its power from young fleet of coal-fired power plants4 and lags in solar adoption due to delays in regulations for accelerate renewable. The Philippines must manage distributed demand across more than 7,000 islands, creating logistical and technical challenges for grid development5. Electricity in Cambodia remains among the most expensive in the region due to a lack of integrated high-voltage transmission systems and dependency on imported fossil fuels with limited diversification6. And while Thailand has made notable progress in clean energy policy, centralised planning still overshadows the potential of decentralised solutions like DERs.

Common to all five countries are challenges around balancing economic growth, environmental sustainability, and energy access, particularly in remote or underserved areas. Accelerating clean energy deployment will require both large-scale infrastructure and more flexible, locally driven systems.

Current approaches and limitations

Across ASEAN, governments have introduced national renewable energy targets, feed-in tariffs, and auctions to incentivise clean energy investment. However, these policies have typically focused on utility-scale projects and grid-connected generation.

In many countries, DERs remain underutilized or unregulated. In Vietnam, rooftop solar uptake surged after favourable FITs were introduced but the absence of long-term planning and grid readiness led to project bottlenecks and retroactive policy changes. Indonesia has launched pilot projects in distributed solar and battery storage, but implementation has been slow due to regulatory barriers and financing gaps7. In the Philippines, small-scale solar is growing in urban areas, but limited technical support and inconsistent permitting remain obstacles8.

These examples highlight a core issue: while DERs have demonstrated strong potential, they are not yet integrated into national energy planning in a systematic way. To shift from ad hoc pilots to scale-ready solutions, policy, market, and grid frameworks must evolve.

AMPERES has worked closely with partners in government, industry, and civil society to explore the role of DERs in advancing a more inclusive and resilient energy system. DERs play a critical role in accelerating the energy transition by decentralizing power generation and bringing it closer to the point of consumption. Unlike traditional large-scale, grid-connected power plants, DERs such as rooftop solar, battery storage systems, microgrids, and community renewable energy projects, are typically installed at or near end-user locations. This proximity enhances energy efficiency by reducing transmission losses and alleviating pressure on central grids, especially in remote or rapidly urbanizing areas. DERs also strengthen grid resilience by enabling localized energy generation and backup during grid outages or peak demand periods.

Moreover, Distributed Energy Resources (DERs) open new pathways for diversified investment in renewable energy by enabling industrial, commercial, residential and household consumers to become energy producers. This democratization of energy supply empowers communities to actively engage in energy transition and supports greater energy equity. It also shares the investment burden to finance new generation capacity with a wider investor base, relieving financial pressure on governments by enabling private sector from the electricity and industrial industries to invest in new generation capacity.

According to the IEA’s Renewables 2022 report, solar PV accounted for nearly 60% of global renewable capacity expansion to 2027, with distributed solar PV playing a key role in accelerating this growth9. By unlocking new forms of financing and ownership, DERs not only complement large-scale infrastructure but also foster a more flexible, inclusive, and resilient energy future.

What’s clear is that DERs won’t solve every challenge but they offer a powerful set of tools when supported by the right policy, technical, and market frameworks.

Key considerations for enabling DERs

Drawing on lessons from Australia and across the region, we have identified four areas where action is needed to unlock the benefits of DERs.

1. A better financing environment for distributed renewables

Creating a more supportive financing environment for distributed renewables could benefit from the introduction of a clear and bankable DPPA (Direct Power Purchase Agreement) mechanism designed for households and industrial users. Such a mechanism would enable owners of rooftop solar, battery systems, or other distributed technologies to sell surplus electricity at fair and predictable rates whether to the grid, local buyers, or energy aggregators. This kind of market access and income certainty may help attract greater private investment, enhance the financial viability of small-scale systems, and encourage wider adoption across both residential and commercial sectors. In doing so, distributed renewables can more effectively complement utility-scale projects and contribute to a more inclusive, flexible, and decentralized energy transition.

2. Establish market oriented and competitive outcomes in both energy and ancillary services markets

Modernising electricity markets is key to supporting renewable integration. This includes setting clear tariff roadmaps, phasing out fossil fuel subsidies, and developing new markets for Essential System Services such as frequency and voltage control. These services are critical for managing the variability of renewables and ensuring grid stability.

Clear, competitive, and transparent pricing mechanisms can also attract new players and technologies, including DER aggregators and demand-side response providers.

3. Manage safe integration of Distributed Energy Resources (DERs)

Uncoordinated rooftop solar development can pose challenges for grid management. In Vietnam, rapid growth in rooftop solar led to technical constraints and policy backtracking. In contrast, Australia has reached over 43% rooftop solar penetration at times, supported by clear standards, system visibility tools, and flexible export mechanisms.

ASEAN countries can adapt these practices by introducing national DER standards, real-time monitoring systems, and incentive programs such as rebates or time-of-use tariffs to align DER deployment with grid needs.

4. Enhance power system resilience

As climate risks increase, decentralized systems can help build resilience by reducing reliance on central infrastructure. DERs, including microgrids and battery storage, offer redundancy and flexibility, especially in disaster-prone or remote areas.

Resilience planning should be integrated into national energy strategies, with a focus on modularity, safe failure, and local capacity. This approach also aligns with energy access goals, ensuring more communities benefit from clean and reliable electricity.

Looking ahead

Distributed Energy Resources will not replace large-scale generation, but they can provide critical flexibility, speed, and local benefits as ASEAN countries pursue more sustainable energy futures. Enabling DERs through thoughtful policy, market, and technical reforms will support not just decarbonization, but also resilience, equity, and system efficiency.

AMPERES continues to work with governments and partners to explore tailored solutions that bring DERs into the heart of national energy strategies. With the right mix of incentives, planning, and collaboration, DERs can become a powerful driver of the region’s energy transition.

About author

Nguyen Phuong Minh Kha is an Energy Transition Coordinator at AMPERES

AMPERES has been working across Asia and the Pacific since 2017 to support clean energy transitions, with a focus on distributed solutions that are technically feasible, locally led, and system aligned.

Our energy transition portfolio includes:

- Supporting community-owned renewable energy (CORE) in remote and off-grid areas through planning and feasibility assessments. AMPERES implemented the project Establishing a Community Renewable Energy Association for the Greater Mekong unlocked the potential for modular, distributed electricity systems in fringe grid and off-grid villages of the Greater Mekong. These systems have significant environmental, health and livelihood benefits for tens of millions of people in rural communities of the region, but they have also opened opportunities for community management and ownership of their own electricity services.

- Policy and regulatory consultation for government to foster the development of solar and other distributed energy resources. Our work with the Australian Department of Foreign Affairs and Trade (DFAT) in Vietnam has involved providing input on market mechanisms and DER management to inform long-term energy strategies through FE-V initiative.

Facilitating high-level dialogue and capacity building. Through initiatives like the Future of Electricity – Vietnam and Southeast Asia Energy Transition Partnership Round Table, AMPERES has co-hosted several technical discussions with energy authorities and regulators to support peer learning and evidence-based policy making.